nys workers comp taxes

The amount of workers compensation that becomes taxable is determined by how much the Social Security Administration SSA reduces your disability payments. If you and your employee.

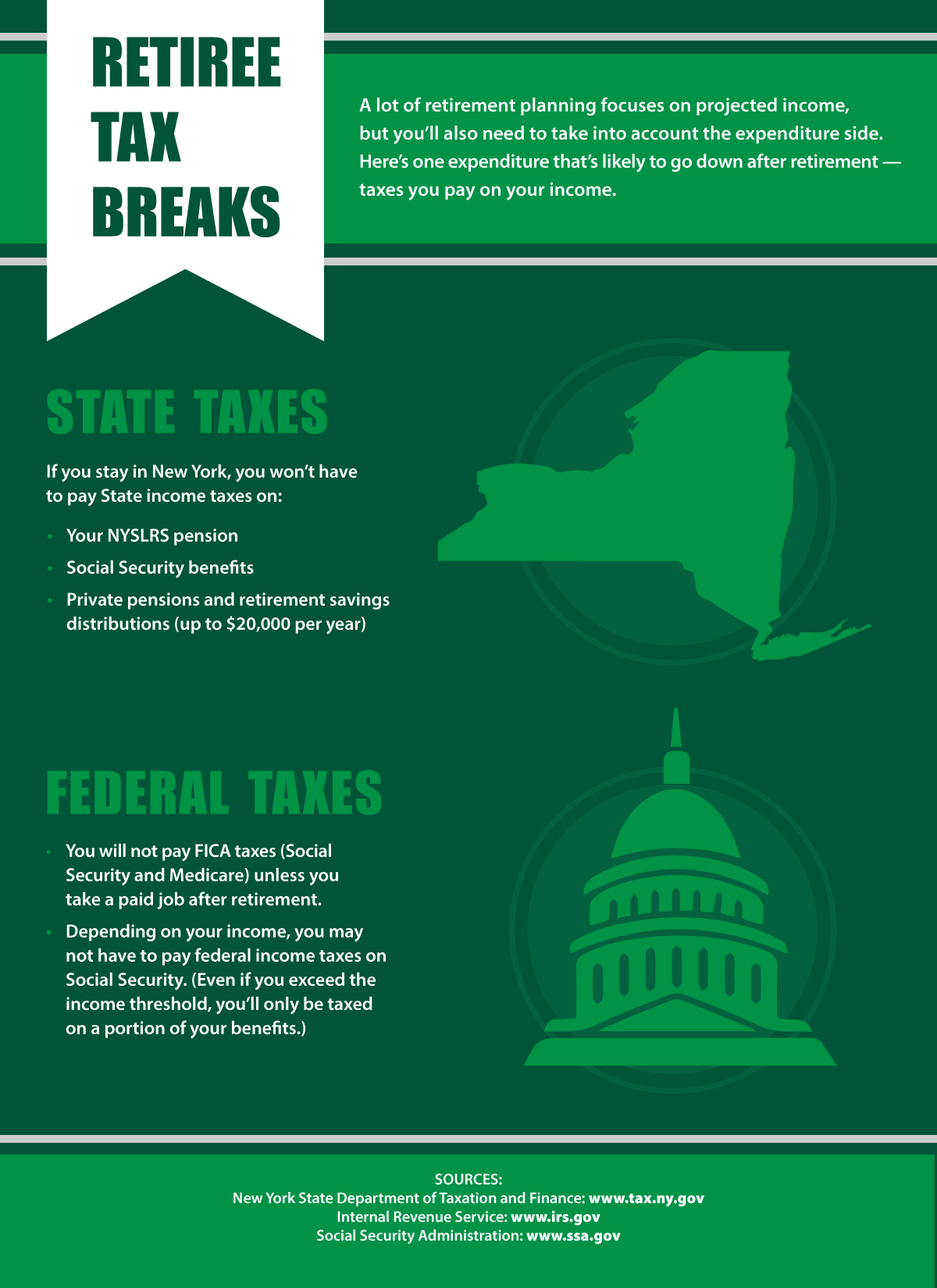

Taxes After Retirement New York Retirement News

Families sued the factorys owners in civil court and won but the.

. The Workers Compensation Board is a state agency that processes the claims. The minimum tax is 250. Work comp rates for all job classification codes are always expressed as a percentage of 100 in wages.

As luck would have it a New York judge struck down the states first workers compensation law the day before the fire. OnBoard will be temporarily unavailable for scheduled maintenance from 600 pm. The IRS in Publication.

Also under IRS regulations non-taxable workers. A recent study conducted by the Department of Consumer Affairs indicates that New York is currently the 4th highest state on average for workers comp rates. A business that fails to maintain workers compensation insurance can be penalized 2000 per 10-day period of noncompliance.

This is in addition to any actual award stemming from a. If the FEIN on the policy is the correct legal FEIN and the FEIN on this notice is incorrect send a copy of your CP575 issued by the Internal Revenue Service IRS to the New York State. Since the employee originally had taxes withheld when previously paid.

Forms required to be filed along with instructions can be. Workers compensation-related benefits are also exempt from New York State and local income taxes if applicable. The Advocate for Business offers educational presentations on topics important to business such as an.

Ny state workers compensation rates nys workers comp rates 2020 nys workers compensation rate schedule nys workers compensation insurance rates new york workers compensation. ET Thursday October 6 2022 through 700 am. NYS Workers Compensation Board - Home Page.

It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury. Withholding tax Withholding tax Employers are required to withhold and pay personal income taxes on wages salaries bonuses commissions and other similar income. Withholding income tax federal or New York State from wages paid to household employees is voluntary on your part and on your employees part.

OnBoard will be temporarily unavailable for scheduled maintenance from 600 pm. If Board intervention is necessary it will determine whether that insurer will reimburse for cash benefits. ET Thursday October 6 2022 through 700 am.

The quick answer is that generally workers compensation benefits are not taxable. The amount of the Award is exempt from taxes including Social Security and Medicare withholdings. Generally the Internal Revenue Service IRS does not consider NY workers compensation benefits to be taxable income.

Are workers compensation benefits taxable. The tax rate is 175 for accident and health premiums and 200 for all other non-life premiums. Get information about the benefits available under workers compensation including medical care lost wages and benefits for survivors.

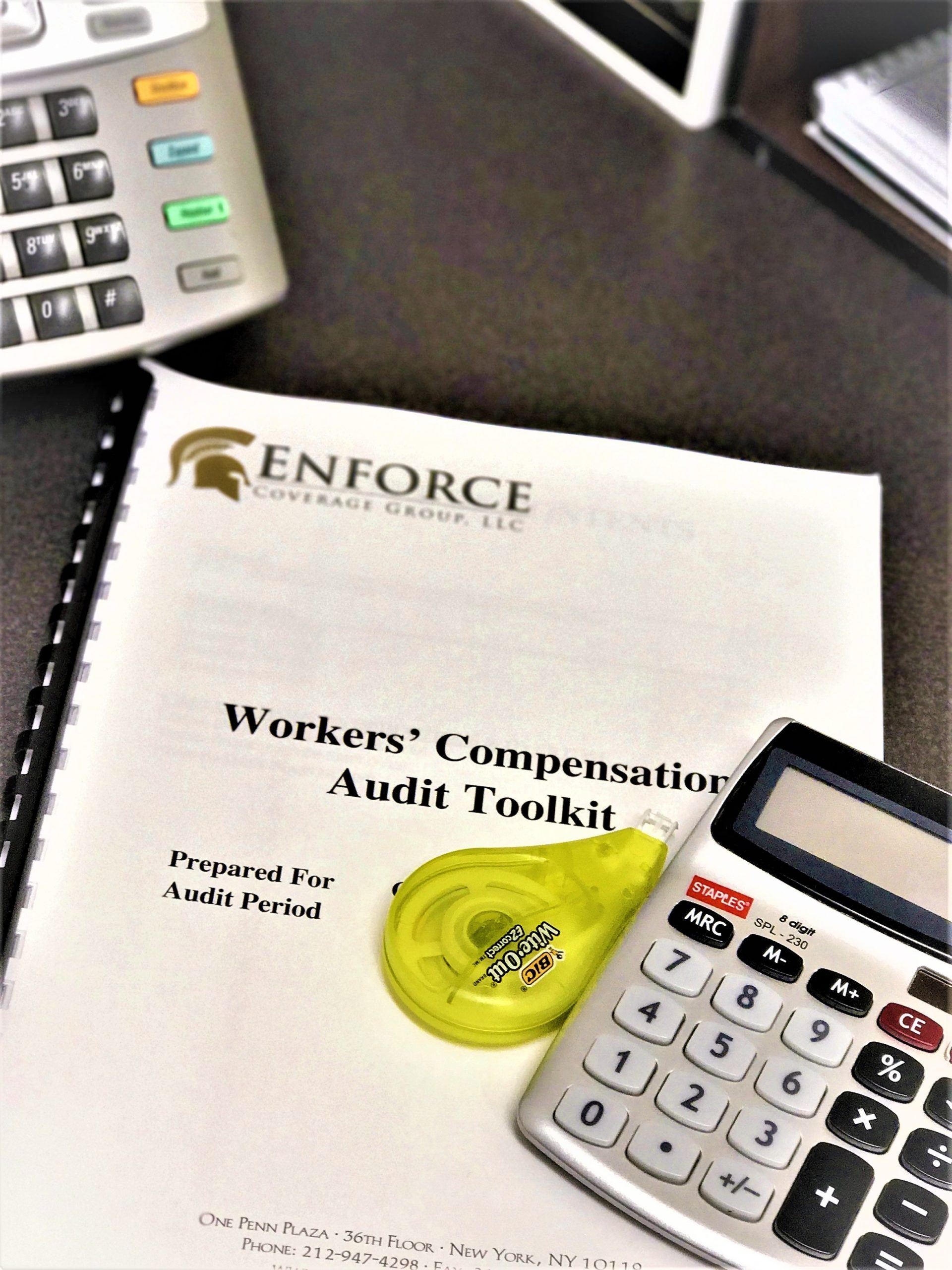

Information for Employers regarding Workers Compensation Coverage. An annual policy is always subject to an audit because it was based on estimated.

Are Workers Compensation Benefits Taxable In New York

Are Workers Compensation Benefits Considered Taxable Income Lois Law Firm

Nys Workers Compensation Audits

Recent Workers Compensation Decisions On 114 A Show Fraud Doesn T Pay In New York Knowledge Goldberg Segalla

Nys Workers Comp Nysworkerscomp Twitter

Income Tax Services The Tax Shelter Athens Ga

Ny Workers Compensation Insurance Get Insured Fast

How To Delegate Payroll Employee Related Tax Filings And Associated Employer Duties To A Professional Employer Organization The Cpa Journal

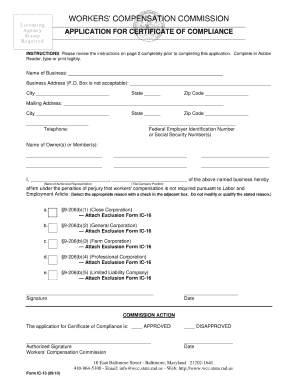

20 Printable Nys Workers Compensation Exemption Form Templates Fillable Samples In Pdf Word To Download Pdffiller

Ecep Ecet What Employers And Employees Need To Know About New Nys Payroll Tax Ashley Explains 06

![]()

New York Nanny Tax Rules Poppins Payroll Poppins Payroll

Is Workers Compensation Insurance Required In New York

Workers Comp And Working At Home New York State Bar Association

Workers Compensation Payroll Calculation How To Get It Right

![]()

Comp Official Allegedly Stretched Day Of Leave Into Yearlong Loot Business Insurance

N Y Don T Leave Money On The Table This Tax Season New York Daily News

A Complete Guide To New York Payroll Taxes

B I C Brokerage Corp New York Ny Facebook

Ny Workers Comp Max Settlement Amounts Paul Giannetti Attorney At Law